INVEST IN THE COMPANY SET TO UNLOCK 1M TONS OF TUNGSTEN

Tungsten is essential to defense applications like missiles, tanks, and bulletproof tech, but 84% of global supply is controlled by China. United States Tungsten is bringing America’s largest tungsten mine back into production to provide a reliable, domestic supply. With 1 million tons of minerals under lease and support from federal agencies, we’re moving toward full commercial operations.

Help shore up America’s defense as an early-stage investor.

"Developing a domestic source for tungsten is one of our top critical and strategic mineral priorities." 1

Tungsten Is Irreplaceable, and 84% of Global Supply Is Off Limits

The market for tungsten is worth $3.2B annually2, but China currently controls 84% of global supply.

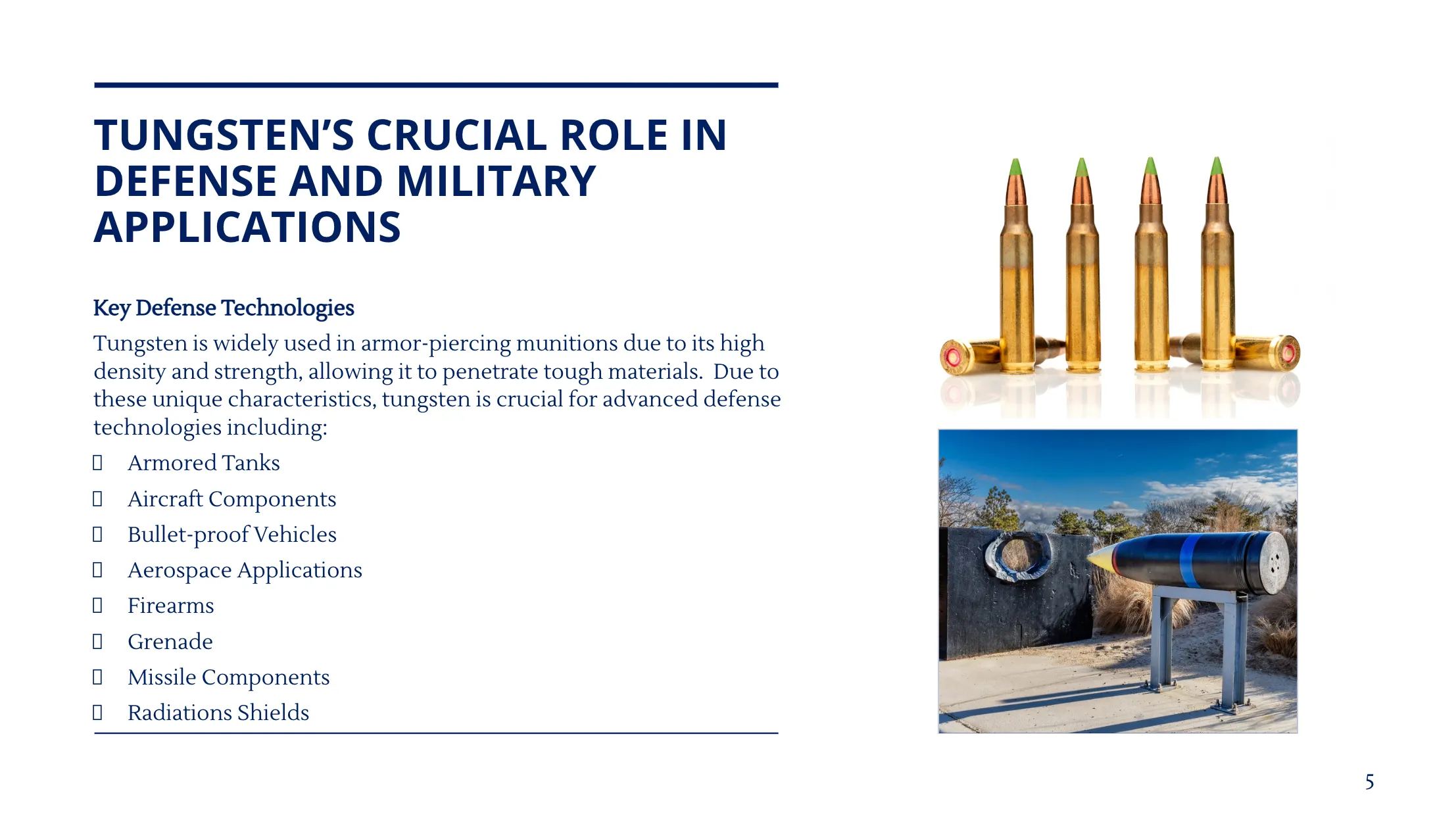

Military Dependence:

Used in armor-piercing shells, missile systems, aerospace alloys, bulletproof protection, and more.

No Substitute:

Highest melting point of any element (6,192°F), extremely dense, and exceptionally hard.

New Restrictions:

Recent U.S. defense policy prohibits buying Chinese tungsten, leaving a major supply gap.

Rising Prices:

With global supply tightening, tungsten prices are approaching all-time highs.

Investing In American Tungsten Has Never Been More Important Than Now

All at once, Department of War is restricting foreign minerals imports, ramping up demand for armor and missiles, and offering contracts to early-movers like us.

Revive America’s Largest Tungsten Mine

We hold the lease to what used to be America’s largest tungsten mine, a site with an estimated 1M untapped tons of total minerals. Our opportunity offers:

“Tungsten is not just another industrial metal. It is one of the most indispensable elements for national defense.“ 3

A Shovel-Ready Mine With Mounting Federal Support

United States Tungsten is already advancing a project aligned with U.S. national security priorities. With key approvals secured and federal engagement underway, we’re taking the necessary steps to reestablish domestic tungsten production.

DoW engagement:

Actively in talks with the Department of War about supply contracts

Established network:

Direct ties to defense officials and contractors, ensuring alignment with national priorities and fast-track access to buyers

Shovel-ready:

Site planning and environmental assessments already in motion

Get the investor deck

The U.S. Will Spend $901B on Defense in 20264

From executive orders to direct DoW funding, the U.S. government is prioritizing domestic critical minerals supply chains, especially given their importance to national defense.

Readymade Infrastructure, 40% Cheaper Transportation

Because our mining territory used to be the top-producing tungsten site in America, it already has built-in infrastructure. Our location reduces transportation costs by 40% compared to overseas supply chains and ensures rapid deployment thanks to:

Close proximity

to defense contractors and processing facilities

Established networks

for transportation and logistics

Streamlined framework

for permitting and regulations

1M Tons of High-Grade Tungsten, 99.9% Pure

Our North Carolina deposit is incredibly high-grade. That means lower processing costs, fewer impurities, and more value per ton extracted. For buyers like the Department of War, purity matters. For investors, so does scale.

Tons Estimated

Purity Achievable

Year Mine Life

Our Road to Commercial Production by 2027

We’re fast-tracking a development plan to bring America’s largest tungsten resource back into production within 24 months. With infrastructure in place and strong federal momentum on our side, here’s the three-phase plan that gets us to full commercial operations.

Phase 1:

Permitting & Financing (6–8 months)

Environmental assessments, final site surveys, and capital raise to fund construction.

Phase 2:

Infrastructure Development (8–10 months)

Site prep, facility buildout, equipment deployment, and operational staffing.

Phase 3:

Production Ramp-Up (6–8 months)

Initial tungsten output, direct-to-defense market entry, and scale-up to full production.

100+ Years of Industry Expertise

With decades of experience and key relationships across mining, critical minerals, energy, finance, and federal regulatory environments, our team is strategically assembled to maximize this opportunity.

Owner of Environmental Operations with 30+ years of experience with redevelopment projects. CEO & Director of US Strategic Metals.

25+ years of experience in the global commodities and mining space with Glencore And Glencore Services. Former Board member of US Strategic Metals.

Chairman of Waterfield Holdings, Chairman of US Strategic Metals, Chairman Emeritus of YPO International, Former Goldman Sachs & Co, and former director of Aspire Software (Nasdaq: ASUR), RF Industries (Nasdaq: RFIL), SMTC Corp. (Nasdaq: SMTX).

Lisa has over 30 years in the mining industry, predominantly in base and precious metals. Project Development roles in minerals processing, pyrometallurgy and hydrometallurgy, utilities and specialty reagent plants, as a technical specialist and project manager/director. She also supports as a competent person for ASX reporting and qualified person for TSX technical reports.

Heather J. Bliss serves as the Chief of Staff for United States Tungsten as well as many Companies under the Waterfield Holdings portfolio. Since joining Waterfield in 2017, she has been instrumental in advancing strategic investments, overseeing operational initiatives, and supporting the success of multiple business entities within the organization's diverse portfolio.

Earn Bonus Stock When You Invest Early

We’re offering bonus shares to reward early participation and build strong early traction in this raise. These bonuses give you more shares for the same dollar invested. The earlier your investment, the greater your bonus potential.

Frequently Asked Questions

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of United States Tungsten (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities;

• An accredited investor;

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships).

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.